We all need money to provide our families with the things they need. As a couple, it may be difficult to talk about money.You both should trust each other and work together when deciding how the money will be spent.

Today I will focus on those that are living together, in particular how to manage money in a marriage. Why reasonable money control is essential in marriage, what is required to learn when you live together, how to control money flow, how to share equitably and what to do when the problem occurs.

Importance Of Money

In most marriages, money is the main reason for arguments. And not only that, it goes even further.

It is never easy to talk about money, especially if there isn’t enough of it. And from one point, I am sure you will agree there is never enough money.

So what can you do then? The first step is to start visualizing. It is easy to overspend when you can’t see the money leaving your wallet or purse.

Decide to dedicate a particular amount of money which you will both spend. And when buying for food, always pay with cash.

Learn To Control Spending

If you end up with a low budget, or even worse, with no money before your next paycheck comes it must have been your spouse fault, correct? Not so fast!

You two are a team, so consider some factors that may have caused both of you to get into such predicament. If you were living at home before you got married, you may be new to the world of paying bills and sharing expenses.

It could be that you and your partner have different approaches to money. For example, one might be more prone to spend while the other is more inclined to save.

It takes time for a couple to adjust and develop a method of handling money. A very effective way is to share your expenses equally.

What Is Mine Is Yours

When both of you are working, setting up a budget to spend can be tricky. Especially if one has a higher salary than other. Putting all of your money in a joint account requires mutual trust and shared a commitment toward the same goal.

Plan together how will you spend your money. Decide what you need to buy and how much you can afford to spend. Just because you have the money to buy something doesn’t mean you should.

It is not strange that the wife leaves finances to the husband (or another way around). If one takes such responsibility, he/she should always consult another one when making a major decision with finances. Communicating about money will help to maintain peace in your marriage.

Fair Vs Equal

If you, however, decide to have separates accounts, one method of handling expenses can be dividing some percentage to cover shared costs such as a mortgage, water, and heat.

Splitting your money to fair share doesn’t mean you have to split it equally. If you earn $10,000 and your partner makes $5,000, allocating 50% of your money would mean you contribute with $5,000 and your partner with $2,500.

How can you decide what the required amount needed for the household is? Write down all of your expenses, no matter how small they are. Leave nothing out. Do this for one month.

That will help you to figure out where your money is going and to identify any unnecessary expenditures. Once you have a clear overview of your money flow, you can decide to increase joint capital or redirect it to other needs.

Also, if you manage to save money in one field, keep it for another month or transfer it for a different purpose.

Make Adjustments

Go through all of your expenses. Do you pay for something you rarely use or don’t use at all anymore? Do you really need all the channels on cable TV? Maybe you can switch to a different (cheaper) provider.

A magazine subscription is another thing where you can save money. Lots of it you can read online these days, so subscription is often just another expenditure which you can avoid.

Do you enjoy eating out? Sure, it is nice to go out for dinner and relax, but doing so often can hurt your finances in the long run.

Learn to say no to some things in order to live with your means.

Dealing With Problems

Sometimes unexpected situations will occur, and you will be left short of money. No matter whose fault is it, the most important thing is not to fight about it.

Yes, I know it is easy to say that when you are not in such a situation. But if you approach the problem rationally and talk with a cool head, a tense situation can easily be avoided.

Fighting over money has never brought any good, and will not bring, ever! So sooner you accept the situation as it is and start working on damage control, easier it will get.

Don’t point fingers at each other, and try to avoid tension. Talk before such problem arises and set rule how will you manage such a situation.

You could decide to cut on things you plan for relaxing or enjoyment. If you talk about such a possible scenario, easier it will be to deal with it once it occurs.

Conclusion

Lack of funds is hard as it is, so the best use of what you have. Decide your budget, avoid debt any mean necessary. Spend only the money you have and don’t try to live life your budget can’t follow.

Always plan for unplanned expenses, such as repair on a car or small house investments. If you have extra money at the end of the month, decide together what you are going to do with it. If you have a deficit, however, make specific plans to reduce your expenses.

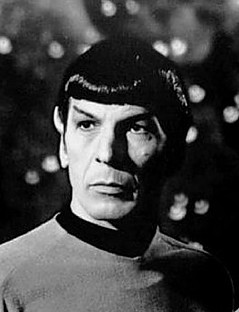

In the end, let me repeat main lines, in a manner only Spock would say:

- Visualize Money

- Control Spending

- Set A Budget

- Split Fair

- Make Adjustments

- Damage Control

Hopefully, this article will help you avoid some mistakes. Did you find something useful? What is your secret in managing money? Share your opinion and how you deal with money management. I would love to hear your side!